Competing firms are termed as colluding when they make some agreement about output and pricing. These agreements may be either facet or formal. But open or formal agreements are not legal in most countries. The oligopolists’ agreement between two firms is generally secret or tacit. A collusive oligopoly comes into the frame when the firm enters a collusive agreement.

Types of Collusive Oligopoly

Collusive oligopoly can be of the following two types:

- Cartels/Perfect collusion, and

- Imperfect collusion.

Conditions for Successful Collusive Oligopoly

It is not equally possible to get into agreements to raise prices in all industries. There can be a successful collision only when the following conditions are present:

1. Number of Firms is Small

As the number of firms increases, arriving at and maintaining collusive agreements becomes costlier. With the increase of oligopolists, there is a breakdown in the collusive agreements. It is one of the main conditions for successful collusive oligopoly.

2. Secret Price Cuts by Rival Oligopolists is Easier to Detect

Some collusive oligopoly firms often tend to cut prices that are not easily detectable, e.g., providing better delivery, better credit facilities, and other related services ‘free’ to attract more customers. In differentiated products, the collusion partners use style and quality improvements as competitive weapons. These render only collusive price agreements of limited value. Thus, a firm may lead to a breakdown of the collusive agreements in case a firm has an easy way of ‘policing’ the rival’s pricing policy and the related aspects.

3. Threat of Entry Potential Rivals

Since there are no entry barriers for new firms in the market of collusive oligopoly. The oligopolists will not be able to make a high profit over a longer duration. Also, competitors in the industry may attract from temporarily successful collusion, thereby eliminating profits. Therefore, long-run profits will not possible without the blockage of industrial entry.

4. Stable Demand Conditions

While the market demand conditions are not stable, it results in firms’ differences regarding their future demand and expectations. Among oligopolistic firms, this tends to be a potential conflict area. Thus, when demand is relatively stable, there are more chances of successful collaboration.

5. Less Fear of Anti-Trust Action

Under antitrust laws, there is no permission for collusive agreements. Therefore, the firms enter these agreements secretly, and the arrangement is informal cooperation.

Types of Collusive Oligopoly

1. Cartels/Perfect Collusion

The market price is driven down to the production cost level when rival oligopolists compete over price. Therefore, there is a strong incentive for oligopolists collusion, leading to a price rise and restriction in output. The opposite of competition is cooperation. It states that the firms cooperate to take joint actions that strengthen their bargaining position against the customer. There are cartel agreements primarily in perfect cooperation.

A Cartel of collusive oligopoly is an explicit agreement carries among independent firms on various subjects such as output, prices, market share, etc. The firm’s desire to earn large joint profits provides the impulse to form cartels. Thus, the cartel’s formal arrangement cannot be a phenomenon of long duration. There are two types of cartels.

i) Centralised Cartels, and

ii) Market-sharing Cartels.

In the case of centralized cartels, the output, pricing, distribution, and sales of profits are made by a central cartel association of all the firms. In the case of market sharing cartels, the firms that form a cartel would agree on the market shares, with or without any common understanding of prices.

i) Centralized Cartels

Central Cartel Board takes the decisions for the whole industry, along with every member firm, to gain maximum joint profits under the centralized cartel system. The Cartel Board fixes the output quota of each member firm. As per the prior agreement, total profits distributes among the firms. The total industrial output and price determines in such a way that there is a low total production cost.

Let us assume only two firms are there in collusive oligopoly. Further, assuming that the central cartel board knows the industry’s average revenue curve (demand curve) and corresponding total marginal revenue curve. The CMC (Combined Marginal Cost) curve for the industry calculates after horizontal summation of the MC curves of the two firms. Determining the industrial profit-maximizing output is done by equating combined marginal revenue and marginal cost. The illustration of the price-output determination is given in figure 6.23.

In figure 6.23, CMR and AR (D) are the industry’s marginal revenue and demand curves. Where CMC represents the combined marginal cost curve At point E, the industry is in equilibrium where EMC cuts CMR Q is the Equilibrium output. Thus, OP is the equilibrium price. Now, the main question arises how to determine each firm’s output quota. Here, each firm have to produce enough output, at which the MC of each firm becomes equal to the MC of total output at equilibrium. Thus, each firm’s marginal cost will be equal.

ii) Market Sharing Cartel

The following two methods can define market sharing of cartel collusive oligopoly:

a) Market Sharing by Non-price Competition

Firms do agree to sell goods at a uniform price already agreed upon by all. But there is freedom for member firms to produce and sell the quantity at which they can achieve maximum profits. Also, there is the freedom to change the product design and other methods except for any price change to promote sales. While the firm’s cost is the same, the agreed uniform price acts as the monopoly price.

Low prices will be fixed in the case when there is a new firm entry threat. If the production cost differs, the prices fixes after the bargaining process between firms. Also, one more thing is that even a high-cost firm at an agreed price gets some profits. But while the production cost differs, the cartel is unstable because low-cost firms will tempt to lower prices more to increase their profits. Low-cost firms may even give secret concessions to buyers. Thus, the cartel will not work, leading to a breakdown.

b) Market Sharing by Quota

The collusive oligopoly firms may agree on the output quota they produce and sell this quantity at a uniform price. If the costs and products of different firms are perfectly identical, then, in this case, each firm’s price and output quota can be determined, such to maximize the profits, Le, emerging of monopoly solution will be there. In cases of production cost differences, the firm’s quota decides after bargaining between firms based on the past sales of firms or the productive firm’s capacity.

There can be another form of market-sharing quota in collusive oligopoly. Rather than determining each firm’s uniform quota and marketers may use price by the cartel, geographical market division between cartel firms. In this arrangement, there may be differences in the output and prices. However, it is noticeable that all types of cartels are temporary, where production cost is different for different firms in the oligopoly market. Cartels do collapse sooner or later in such cases.

2. Imperfect Collusion

There are few or more than two sellers in an collusive oligopoly situation who are capable of exercising monopolistic influence. We generally find the existence of ‘price leadership’ in such a market situation: One assumes the price leader’s role under price leadership and fixes the product price for the entire industry. It is the types of collusive oligopoly.

Other industrial firms follow the price leader and accept the price, which he fixes, and adjust their output to this price. Generally, a price leader is a dominant or huge firm or the firm whose cost of production is low among all the firms. As a result of a price war, there is an establishment of price leadership where one firm emerges as the winner.

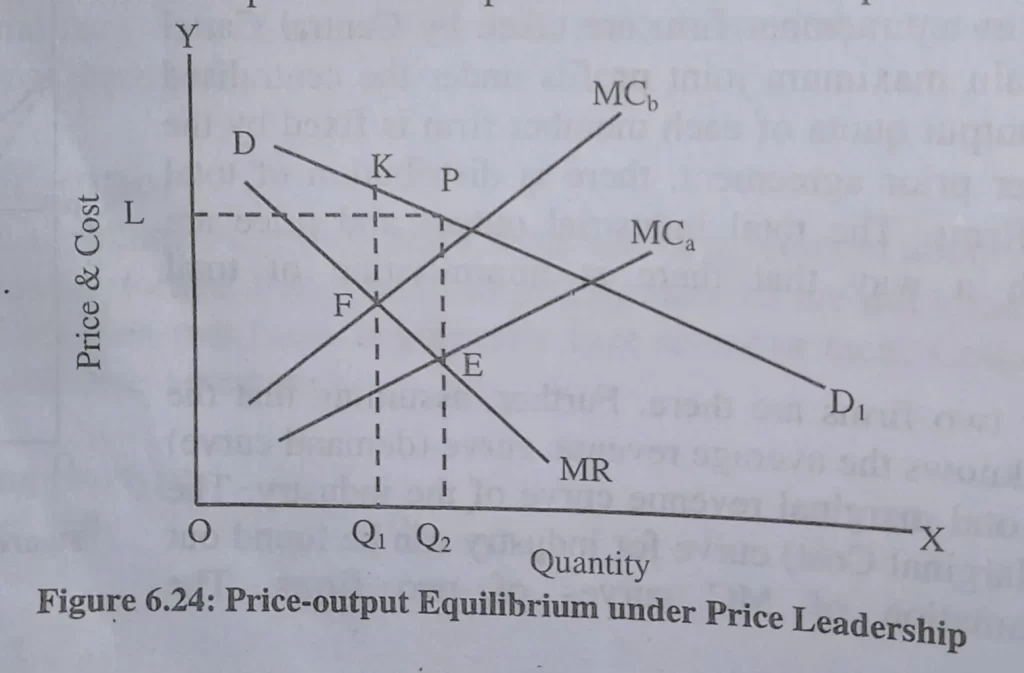

Price-Output Determination under Price Leadership

The economists developed various models related to the determination of price output under price leadership (figure 6.24) based on specific assumptions about the price leader’s behavior and his followers.

Assumptions Under Price Leadership of Collusive Oligopoly

- Only two forms exist, A and B, where A has a lower production cost than B.

- The firm’s product is identical or homogenous, which means consumers are indifferent between the firms,

- There is an equal market share of both A and B firms, i.e., they have the same demand curve that will be half of the total market demand curve.

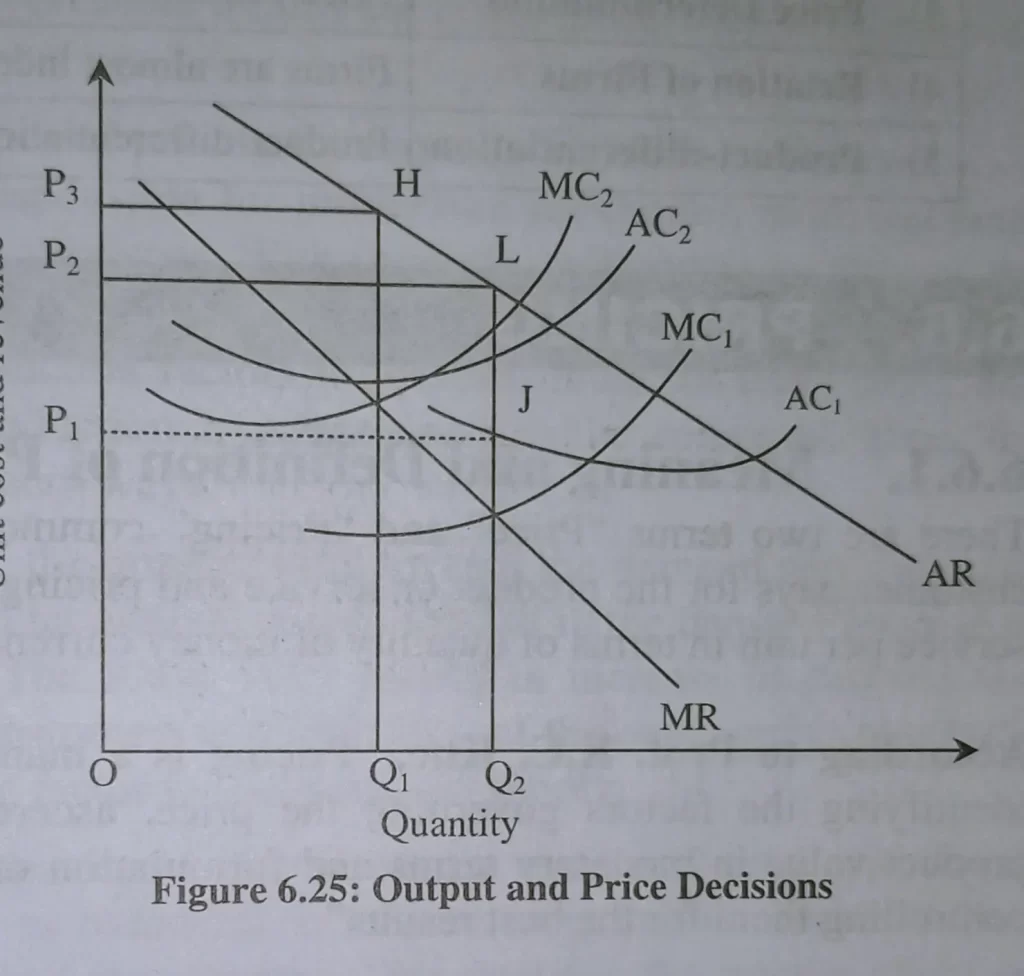

The output and price decisions are in figure 6.25. It is assumed that there are identical revenue curves that are faced by all the firms, as shown by MR and AR curves.

But the cost curves are different: the low-cost or largest firm has its cost curves, MC1 and AC1, whereas all other firms are smaller in size shown by MC2 and AC2.

That is because the most prominent firm shows economies of scale, and its production cost is lower than other firms.

Under given revenue and cost conditions of collusive oligopoly, the firm with low cost would find it more profitable to fix its price at OP2 (= LQ2) and sell quantity OQ2. Profit is maximum at this level since, at this output level, MC = MR. On the other side, profit maximization by the high-cost firms would be at a price OP3 and quantity OQ1. But, if a higher price OP3 charges, they would lose their customers to the low-cost firm.

Therefore, high-cost firms are forced to accept the price OP2, and also recognition of price leadership of the low-cost firm is done. Also, note that the low-cost firm can eliminate other firms from becoming monopolists by cutting the price to OP1 (=JQ2). The low-cost firm can sell its entire output OQ: at price OP, but it only tends to make a nominal profit. However, it may not do so for fear of anti-monopoly laws.

The high-cost firms of collusive oligopoly are therefore forced to accept the price OP2 and recognize the price leadership of the low-cost firm. Note that the low-cost firm can eliminate other firms and become monopolists by cutting the price to OP1 (=JQ2). At price OP, the low-cost firm can sell its entire output OQ2, but it will make only an average profit. It may, however, not do so for fear of anti-monopoly laws.

What is Collusion with Example?

Collusion is when two or more people work together secretly to commit fraud or some other illegal or unethical act. For example, two companies might collude to fix prices, or a company might collude with a government official to get a contract.

How Collusion Affect the Economy?

There is no definitive answer to this question as the effects of collusion on the economy can vary depending on the industry and the specific details of the collusion agreement. In general, however, collusion can lead to higher prices for consumers, reduced competition, and less innovation.

What are the 7 Factors of Collusion?

There are eight factors that affect a company’s likelihood to collude:

1. Size of the firm 2. Market concentration 3. Market transparency and publicity 4. Number of competitors 5. Cost of market entry 6. Product homogeneity 7. Possession of complementary assets