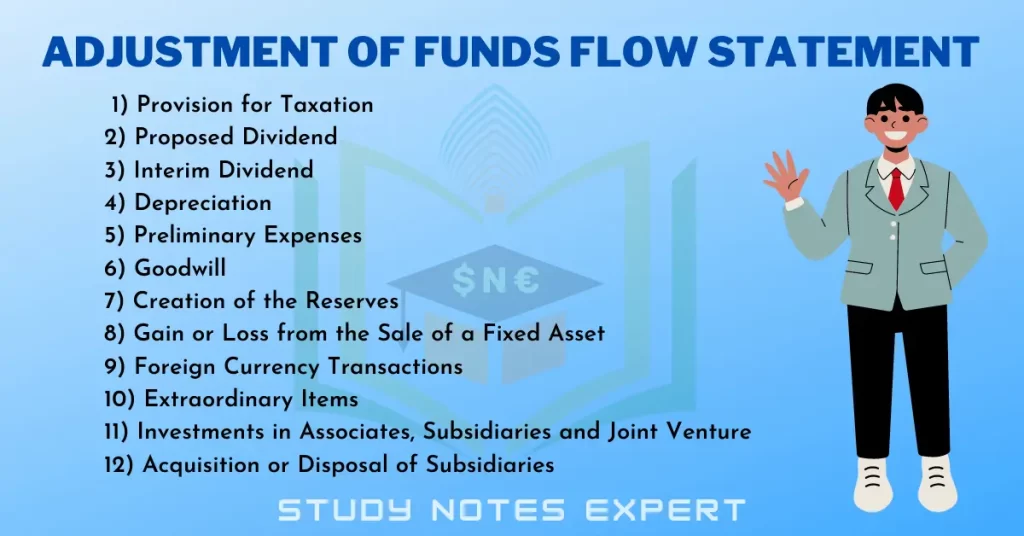

Specific gadgets require changes on the time of instruction of “Funds Flow Statement“.

Adjustment of Funds Flow Statement

Some such objects are as follows:

1) Provision for Taxation

Usually, a ‘Current Liability’ like a “Provision for Taxation” wishes to be proven inside the declaration of adjustments in the running capital. However, the treatment for provision for taxation, if supplied in the adjustment, needed to be treated as “Non-Current Liability’. Such provision made should be added to the earnings, which will calculate the Funds from Operations. In the adjustment of Funds Flow Statement, the tax paid is proven as an Application of Funds.

2) Proposed Dividend

The proposed dividend is just like that of Provision for Taxation. As such, it wishes to be handled in an equal manner.

3) Interim Dividend

Declaration of Interim Dividend is an interim measure taken through a corporation’s Board of Directors between two annual preferred conferences before a final selection concerning the dividend statement is taken. This debit object is charged to the ‘Profit and Loss Adjustment Account’ and is considered an adjustment of funds flow statement.

4) Depreciation

Depreciation is a rate that represents the cost incurred to attend to the everyday wear and tear of the ‘Fixed Assets’ owned by a business enterprise within the usual route. It is considered a Non-Operating Expense as it’s miles a ‘Non-Fund Based’ item. It reasons a reduction in the Net Profit, regardless of the reality that money does not pass from it now. ‘Flow of Funds’ isn’t involved inside the Provision for Depreciation. To check the ‘Funds from Operations, if Profit after Depreciation or ‘Provision for Depreciation’ is given, it wishes to be introduced returned to the Net Profit. It is one of the adjustment of funds flow statement.

5) Preliminary Expenses

‘Preliminary Expenses’ also are like ‘Depreciation’ in nature, as they Non-Operating Expenses do no longer have real fees and, as such, are required to be written off. However, as the budget outflow isn’t concerned, it wishes to be added to the ‘Net Profit’ for you to confirm the Funds from Operation.

6) Goodwill

Goodwill, being an intangible asset, does now not have actual cost and, as such, needs to be written off. It is charging from the ‘Profit & Loss Account’ and does now not contain Outflow of Funds/Application of Funds. The amount of goodwill written-off is returned to the Net Profit’ of the yr to determine the Funds from Operations. It is one of the adjustment of funds flow statement.

7) Creation of the Reserves

As a prudent measure, certain reserves and finances are created out of the ‘Net Profit’ and maintained, allowing you to meet specific liability (known liability) or standard liability (unknown legal responsibility). These items are ‘General Reserve’, ‘Specific Reserve’, ‘Reserve Fund’, ‘Sinking Fund’, ‘Workmen Compensation Fund’, and so on. As these items are ‘Non-Current’, the “Working Capital’ does not undergo any modifications. To determine the ‘Funds from Operation’, the modern-day amount of such reserves is delivered to the ‘Net Profit’. It is one of the adjustment of funds flow statement.

8) Gain or Loss from the Sale of a Fixed Asset

The proceeds from the sale of ‘Fixed Assets’ are blanketed in the ‘Net Profit/Loss of a corporation. It is an item of ‘Inflow of Funds’/’Source of Funds’. No adjustment is needed on account of benefit/loss from the sale of constant belongings. However, if unadjusted earnings are treated as a supply, the income/loss on sale of the Fixed Asset desires to be proven within the assertion twice – as soon as inside the ‘Funds from Operations’ and the other inside the ‘Sale of Fixed Assets’. Such earnings or loss must be adjusted to Net Profit/Loss to calculate Funds from Operations.

9) Foreign Currency Transactions

The effect of ‘Exchange Rate Fluctuation’ on the maintaining of Cash and Cash Equivalents in overseas foreign money needs to be suggested separately as a part of the reconciliation of Cash and Cash Equivalents Unrealized gains and losses because of fluctuation in ‘Forex Rates aren’t taken into consideration/handled as “Cash Flows”.

10) Extraordinary Items

‘Cash Flows’ touching on the “Extraordinary Items” must be classified, undoubtedly consistent with the source of the relevant activities like ‘Operating’. ‘Investing’ or ‘Financing ‘, and disclosed separately.

11) Investments in Associates, Subsidiaries and Joint Venture

A business enterprise was having investments in ‘Associates Concerns’, ‘Subsidiaries’ or ‘Joint Ventures’ want to record in the ‘Cash Flow Statement’. Only the Cash Flows touching on the ones among it and the investees, viz. ‘Associates Concerns’, ‘Subsidiaries’ or ‘Joint Ventures’ must be reported.

12) Acquisition or Disposal of Subsidiaries

Cash Flow (Inflow or Outflow) generated from ‘Acquisition’ and ‘Disposal of subsidiaries’ must be shown individually and labelled as investing activities. It is one of the adjustment of funds flow statement. It is of paramount significance to make sure that:

i) Separate disclosure needs to be made in admire of general buy or total disposal;

ii) Disclosure concerning the purchase/disposal consideration status, discharged by means of coins and cash equivalents, must be made.